- 2023-04-19/*! elementor – v3.12.1 – 02-04-2023 */ .elementor-widget-image{text-align:center}.elementor-widget-image a{display:inline-block}.elementor-widget-image a img[src$=“.svg“]{width:48px}.elementor-widget-image img{vertical-align:middle;display:inline-block}

Middle Picture

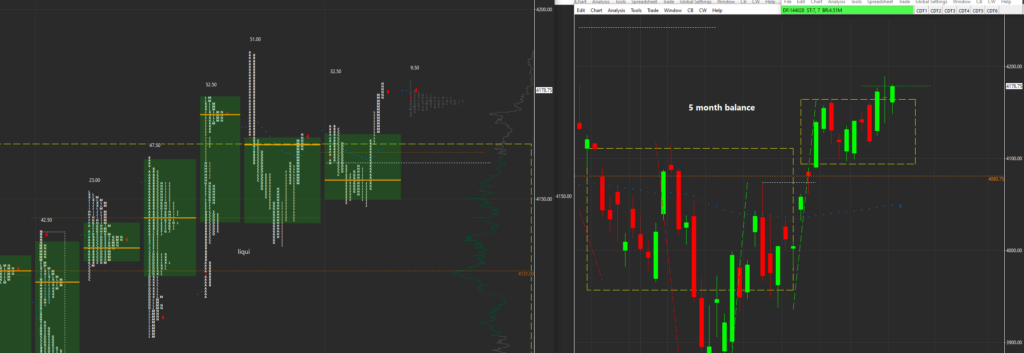

- Normally after going up, we go sideways to consolidate/balance

- These time after going up, we do not balance sideways. We continue to go up but in a slowly grinding way

- Ranges are small

- I think to get better ranges and a better trading market we need a good liquidation to balance inventory

- Keep your expectations low until we see such a change

Intraday

- The last two days we saw the same day-structure. One to the downside. One to the upside

- Its a normal variation day where we see a directional move early followed by nothing but chop and a small correction of actual days inventory

- Do not expect any continuation or second directional move in that actual middle picture !!!

- 2023-04-18/*! elementor – v3.12.1 – 02-04-2023 */ .elementor-widget-image{text-align:center}.elementor-widget-image a{display:inline-block}.elementor-widget-image a img[src$=“.svg“]{width:48px}.elementor-widget-image img{vertical-align:middle;display:inline-block}

The last days this market is very hard to trade

- It indicates a structure but does not complete it like normal

- Neither on the upside nor on the downside

What do i do?

- Everything is temporary. Good times, bad times, everything

- I decrease my expectations and my contract size until we see a better market

- Normal thing

- 2023-04-17/*! elementor – v3.12.1 – 02-04-2023 */ .elementor-widget-image{text-align:center}.elementor-widget-image a{display:inline-block}.elementor-widget-image a img[src$=“.svg“]{width:48px}.elementor-widget-image img{vertical-align:middle;display:inline-block}

- We are in a bullish environment

- Friday we had a liquidation break which strenghtens a market

- I was interested in longs. Unfortunately we had a very very long and slow contra move which ended in K.

- Not tradeable in my market model

- Price probe created a spike

- It resulted in an inside day which should give some opportunity to break out of it as it is a form of balance

- 2023-04-14/*! elementor – v3.12.1 – 02-04-2023 */ .elementor-widget-image{text-align:center}.elementor-widget-image a{display:inline-block}.elementor-widget-image a img[src$=“.svg“]{width:48px}.elementor-widget-image img{vertical-align:middle;display:inline-block}

What happened

- Man, that was again a hard to read week

- We failed two times to break out to the upside of that 7 day balance area. That is normal. But unexpected is that after both failures we do not see continuation to the downside

- I think there was a fed speaker on friday morning that initiated the upside failure

- Sometimes it is more important what did not happen than what happened. What did not happen was the downside continuation

The week ahead

- The market almost always is mainly driven by speculators inventory

- At the moment it seems even more speculator and algo driven

- On the one day they buy it like crazy on the other day they do the opposite

- We sometimes see longer than expected intraday auctions. For example after fridays upside failure we went down in BCDEFGHI.

- Nevertheless we do not get continuation after a pullback but a counter auction that takes back more than vwap and more than mid

- Always keep in mind that algos do not have to trade in logical structure. They can act schizophrenic a long time

- How to navigate such a market. In the end like always: Only take the best entries at good prices after good inventory correction auctions with good change. Scale out humble

- The mechanics of market behaviour stay intact even if we have phases like this. One news, one untypical large execution can mix up the whole structure. There is of course randomness involved. Sometimes more, sometimes less

- This game is a marathon, not a sprint

- 2022-04-12/*! elementor – v3.12.1 – 02-04-2023 */ .elementor-widget-image{text-align:center}.elementor-widget-image a{display:inline-block}.elementor-widget-image a img[src$=“.svg“]{width:48px}.elementor-widget-image img{vertical-align:middle;display:inline-block}

Thoughts before the open

- We spike up in eth with cpi numbers

- But we come back and open only with a small gap

- This is a first indication that eventually we get a look above 7 day balance area and fail

- But we never know. Small gaps often are buyable.

- Like always: Trading is ambigous

What happened

- We have a chaotic first hour

- We get the first directional move in C to the downside. This strenghtens the look above and fail thesis

- Then we get an unexpected nearly 100% percent pullback. In my interpretation this was a gamechanger. If the thesis is correct this should not retrace that much

- Around 2pm we again have some chaos with the fed minutes and we end up with a second directional move to the downside

- In the end ee have a look above and fail on D1. But it retraced nearly 100% intraday and ended with only 47 points of range.

- This is nothing. I interpret the market on D1 as in Balance. Normally we would target the weak low which is the low of that 7 day balance area.

- But the environment is not normal. It is a low volatility environment. Do not target anything from the bigger timeframes. Trade small.

- Perhaps we see more volatility with the upcomin earnings session

Glossary test

Sometimes gap rules have to be applied

When the up auction is finished we see a strong high