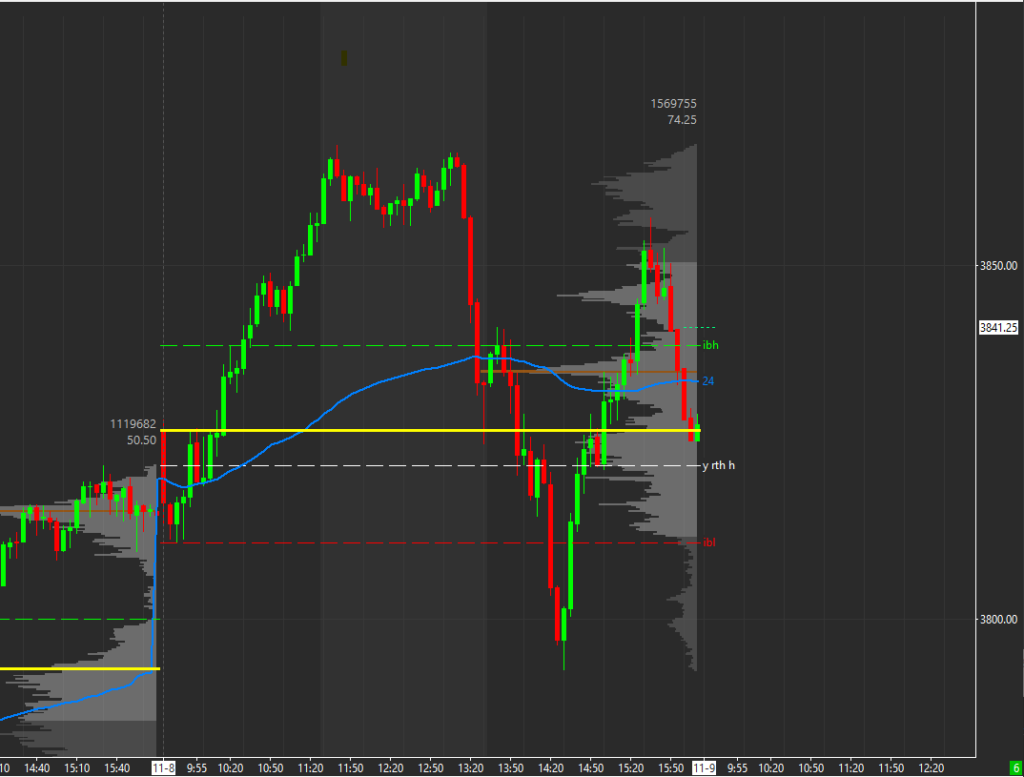

- Small gap up

- A period checks back in upper distribution from yesterday and fails

- We start one time framing higher

- It looks very stable. Contextually we should have more covering potential

- I hit a 20P Target.

- I decide to let a runner run

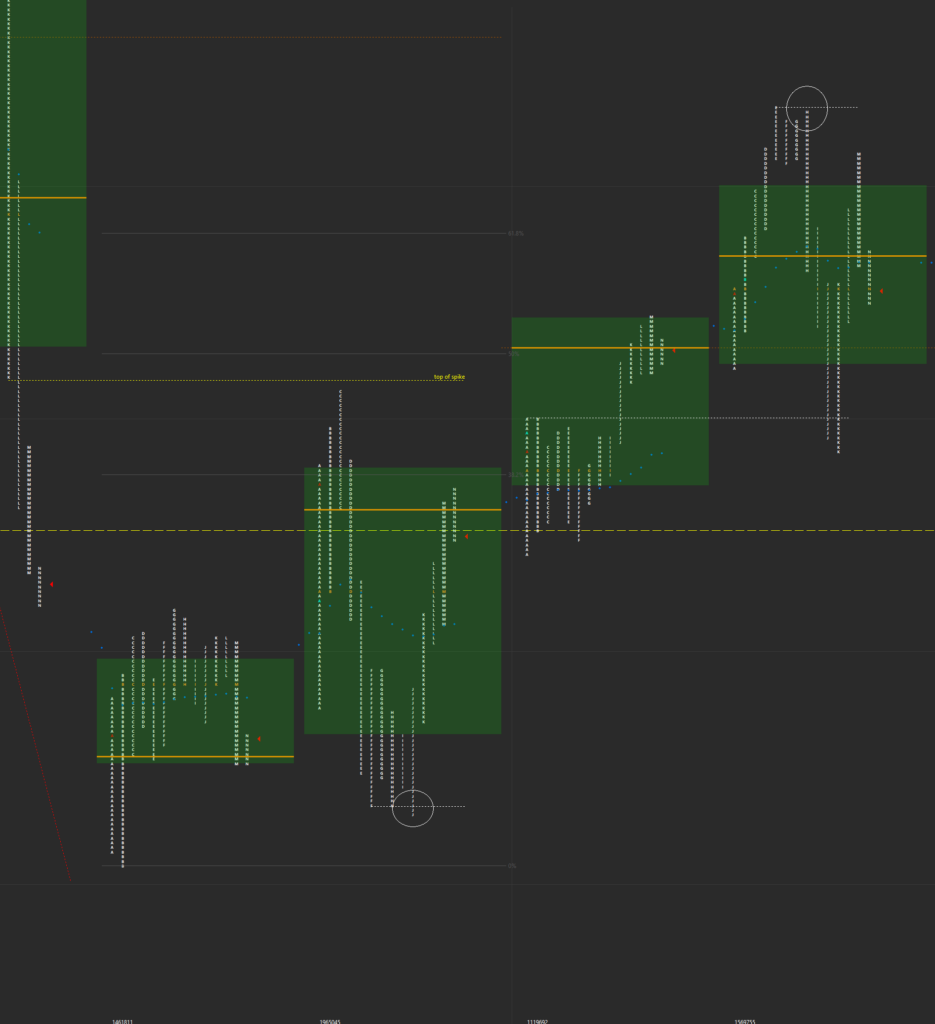

- For me a runner is a trade that i let free of narrow trade management because i think contextually we have room for more (narrative completion, destination trade)

- On Friday i had a similar trade on the short side

Intention of runners

- The intention is to trade the structure of the day as a whole with a small remaining position

- I do this with minimal path dependancy. I do not want to get shaken out by normal contra rotations

- If it works you make big profit and you feel good, because you saw the structure of the market as a whole instead of having to scalp around small in fight with the algos

- In volatile times i sometimes need 2-3 trials before i am in a running trade. In that case i feel that i need to profit accordingly. If this goes too far and you trade your p&l instead of the market this is of course a big problem.

Problem with runners

- Volatility of p&L increases which has much effects: 1) Calmness of mind decreases 2) Ability to increase size decreases

- To balance these large disadvantages runners should have a large positive financial outcome. This is not the case

Believes to influence my behaviour with runners

- The market is full of intraday speculators (too long, too short, need to liquidate/cover)

- Money comes from size and size comes from stability