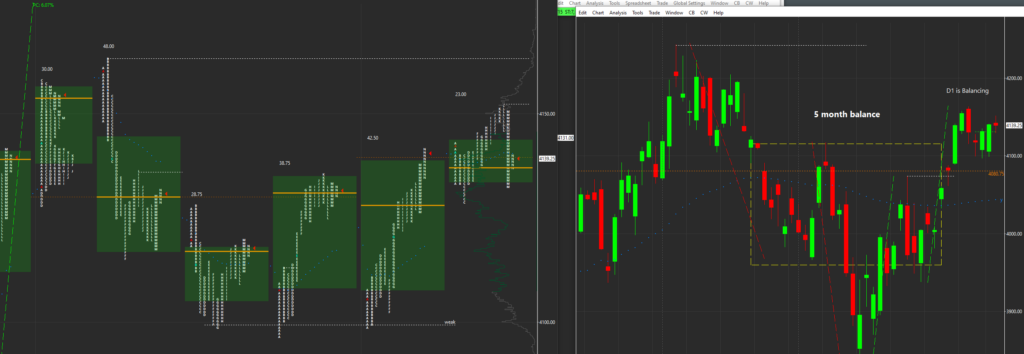

- We come in near yesterdays rth high

- We see an expected inventory correction followed by a directional move. So far so good

- The problem is that the ranges are small. You need to invest some points to identify inflection points and get into a running trade. When you want an adequate win potential you end up seeing that you dont get your targets

- The market does not care about your risk/reward

- At the moment we have low volatility. YOU have to adapt to this

- Only take the best entries. Scale out defensively.

- Low volatility one time leads to high volatility

- The last days i am loosing. But i am loosing very small. This is a normal professional drawdown.

- I improved my trading clearly by focusing more on short term inventory and less on the timeframes above. I enter trades AFTER correction of short term inventory

- In the past i regularly enterd trades more based on medium timeframes which leads to expensive fomo based entries

- If i would not have improved that way i would have a huge drawdown in actual environment, not a small one