Ambiguity of trading

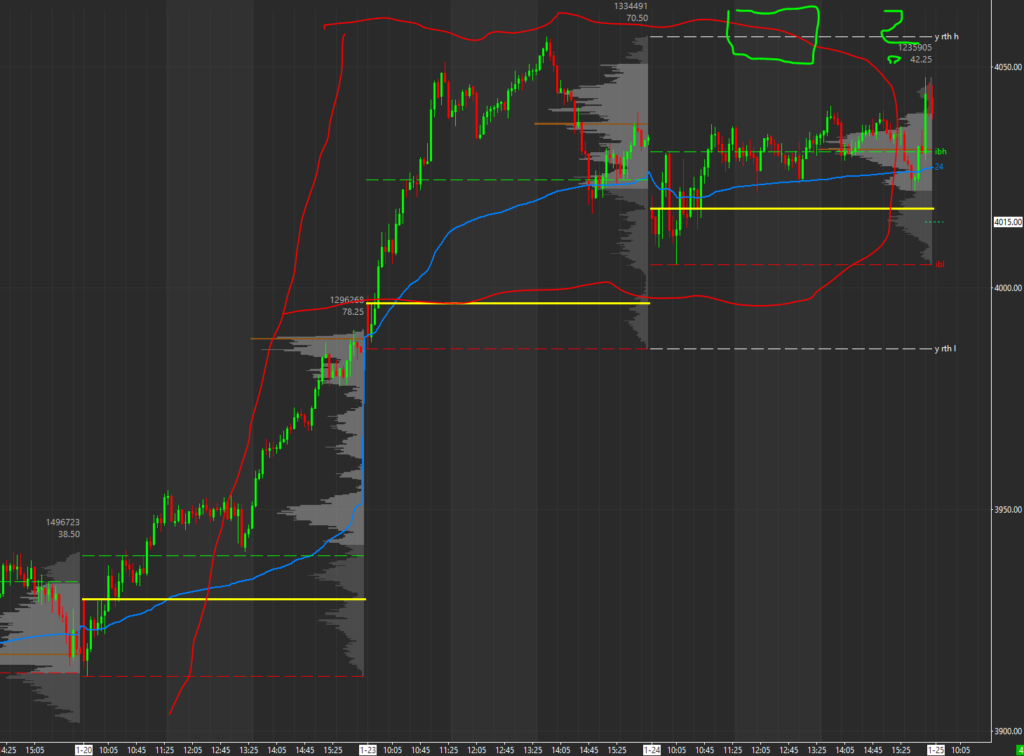

- This is typical for the ambiguity of trading. On one timeframe the market looks ultra bullish and is a strong buy. But on the smaller timeframe the market has already moved a good amount in a short period of time on poor structure (single prints)

- As a pro active person i have more fear of missing out as of a loosing trade. In the past i often was too agressive in these situations and bought too high in relation to tf1.

Combining two timeframes

- You have to combine two time frames. I call the timeframe that i trade tf0. You can also call it daytype. In the hierarchy of timeframes i am a „daytrader“. Below me are the „scalpers“. Above me are the „short term traders“. I call the timeframe above me tf1.

- The most important thing is what is happening live at the moment

- But this you have to embed in what the timeframes above are doing

Skipping a timeframe

- On tf1 we have a strong emotional move which happened in the last two days. Of course, anything can happen, but it would be normal if this at one time starts to balance out and create a covering-p-profile, This is exactly what i have to keep in mind to protect me from buying too agressive in the region of yesterdays high, even if the trade fits perfect in the actual day type tf0.

- This doesn´t mean that i am not allowed to buy there. But i have to carry this point forward and take it into account when deciding in the live-moment.

- It is easy to make the mistake of skipping a timeframe. If i say the market is trying to breakout from the balance area of the last 10 days i miss that it already moved strong for two days

Do not skip a timeframe

- tf0: Lets see what happens today

- tf1: Emotional buying for two days

- tf2: Trying to break out of 10 day balance