„Learn fundamentals, principles, parts of game. Over time intuition learns to integrate more and more principles into a sense of flow. Eventually the foundation is so deeply internalized that it is no longer consciously considered, but is lived. This process continually cycles along as deeper layers of the art are soaked in.“

Josh Waitzkin, The Art of Learning

Principles of Auction Market Theory

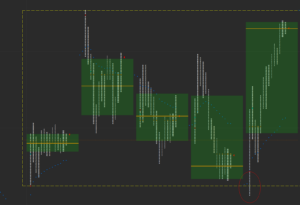

The market is a continous two way auction process

At the actual price we have a limited amount of supply and demand. If we have much buying interest price has to go up to find more sellers. The higher the price goes the more buying interest decreases and selling interest increases. At one point price has gone too far and we get a turning point, because we now have much more selling than buying interest on that high price level.

Now the same happens in the other direction. Price goes down to find more buyers. The lower it goes the more selling interest decreases and buying interest increases. At one point price has gone too far and we again get a turning point. The down-auction is over and a new up-auction starts.

This process continually takes place on all different timeframes. The market is doing his job which is to find Balance so that business can be conducted. The market is always looking for Balance.

MGI – Market generated information

Our job as traders is to analyze these auctions in an objective way. The market gives us three informations to do this. Price, time and volume. The use of other informations like economic news, earnings numbers, etc. is of no value for us as short term traders. The interpretation of these news is by nature very subjective. Additionally algorythms act on these news in milliseconds. As a result we do not trade when important news are scheduled. We trade when normal auctions take place that can be analyzed by price, time and volume.

Price is the advertizer

Price goes down to advertize for buyers. The expected response is to find buyers. If it does not find enough buyers it has to advertize harder and go lower. Rememer that the job of the market is to find balance.

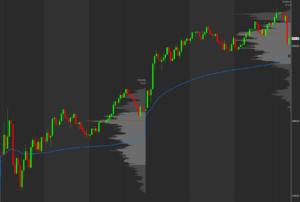

Time is the regulator

Time regulates all opportunity. How much time is spend on a certain price level gives us valuable information. When a price level is a real good buying opportunity it is only available for a short period of time. Price gets rejected very quickly in that case.

Volume is the validator

If an auction goes in the right direction we first see that price is not rejected fast. Secondly we see that business (=volume) is beeing counducted on these new prices. The volume validates that the market is succesful in it´s job to find balance.

Price is not the information

Imagine two people talking about markets:

A: What is the market doing?

B: It is down 1.5% to 120 USD. I think it is because of rumors about x, y, z …

There is no way to act on that information in a rational way. Imagine the conversation going this way:

A: What is the market doing?

B: We opened above yesterdays high but got rejected quickly. We ran fast through the the three-day-balance area and are now finding acceptance below it.

This is useful information. The information is not the price itself. It is how price reacts at important reference areas. If it finds acceptance and volume is executed or if it gets rejected. This way we get a feeling where the market (all involved participants as a whole) actually sees price as too high, where it sees it as too low and most importantly where it sees it as fair. The thousands of different subjective reasons behind that valuation are of no interest for us. We are only interested in that objective MGI that the market as a whole gives us.